rhode island property tax rates 2020

Latest Tax News. 75 of NADA Value and a 5000 ExemptionAll rates are per 1000 of assessment.

Top States To Buy Real Estate In The New Decade Financial Samurai Real Estate Buying Real Estate Real Estate Prices

The FY 2019-2020 property tax rate is 1445 per thousand dollars of assessed valuation.

. 2700 for every 1000. The school-related tax rate is 1072 per thousand dollars of assessed value and the town-related tax rate is 373 per thousand dollars of assessed value. 40 rows West Warwick taxes real property at four distinct rates.

FY 2020 Property Tax Cap. If you wish to pay your tax bill in Town Hall please go to the Finance Department on the first floor of Town Hall 514 Main Street. 6 unit apt Commercial Industrial Mixed Use.

2989 - two to five family. Rhode Island Property Taxes Go To Different State 361800 Avg. Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500 Town Exemption per vehicle.

Paying your Tax Bill. 2700 for every 1000. 1 Rates support fiscal year 2020 for East Providence.

FY 2017 Property Tax Cap. Below we have highlighted a number of tax rates ranks and measures detailing Rhode Islands income tax business tax sales tax and property tax systems. FY 2018 Property Tax Cap.

Please be advised that property assessment information can only be obtained through the Tax Assessors Office. 3000 for every 1000. Ad Search County Records in Your State to Find the Property Tax on Any Address.

2022 Filing Season FAQs - February 1 2022. The current tax rates and exemptions for real estate motor vehicle and tangible property. The current tax rates for the 2021 Tax Bills are.

The Rhode Island Department of Revenue is responsible for. Whether youre estate planning or working on another element of financial planning it can be a good idea to get professional help. The current tax rates for the 2021 Tax Bills are.

PPP loan forgiveness - forms FAQs guidance. 207700 to 231500 210750 to 234750. Counties in Rhode Island collect an average of 135 of a propertys assesed fair market value as property tax per year.

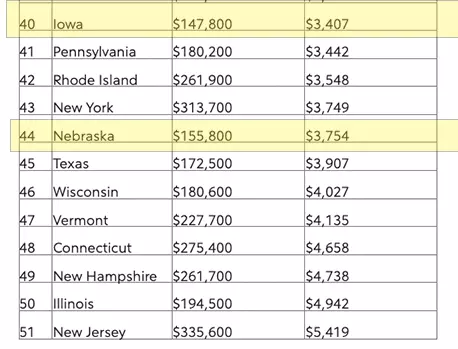

FY 2022 Property Tax Cap. Read the summary of the latest tax changes. 22 rows The average effective property tax rate in Rhode Island is 153 the 10th-highest in the.

The states sales tax rate is 7 and there are no local sales taxes to raise that percentage. 1915thousand dollars of valuation. 2989 - two to five family.

Tax Rate The Town Assessor has set the tax rates for the 2019-2020 fiscal year. 1 to 5 unit family dwelling Residential Vacant Land. Enter an Address to Receive a Complete Property Report with Tax Assessments More.

FREQUENTLY ASKED QUESTIONS. The Tax Rates for the Tax Roll Year 2020 Real Estate 1432 per 1000 Motor Vehicle 1987 per 1000 at 80 of NADA value with a 4000 exemption Tangible 2864 per 1000 Motor Vehicle Tax All Rhode Island residents who own and register a motor vehicle or trailer must annually pay a motor vehicle excise tax. 3000thousand dollars of valuation.

Phase-out range for standard deduction exemption amounts by tax year 2020 2021. East Providence City Hall 145 Taunton Ave. East Providence RI 02914 401 435-7500.

Tax assessments are set annually as of December 31st. 3000 for every 1000. 135 of home value Tax amount varies by county The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000.

1800 for every 1000. 1915thousand dollars of valuation. Click the tabs below to explore.

1915thousand dollars of valuation. The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Rhode Island Division of Taxation - Page 3 of 5.

1800 for every 1000. 2 Municipality had a revaluation or statistical update effective 123119. Questions related to taxes and taxes due should be directed to the Finance OfficeTax Collections.

Which was 5950 for 2020 will be 6000 21. So for example a rate of 2000 is equal to 20 in tax for every 1000 in assessed value. 3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value.

FY2022 starts July 1 2021 and ends June 30 2022Residential Real Estate - 1873Commercial Industrial Real Estate - 2810Personal Property - Tangible - 3746Motor Vehicles - 3000Motor vehicle phase out exemption. Rhode Island Property Tax Rates. FY 2016 Property Tax Cap.

Tax rates are expressed in dollars per 1000 of assessed value. 7 Rates rounded to two decimals 8 Denotes homestead exemption available 6 Motor vehicles in Portsmouth Richmond Scituate are assessed at. Paying your Tax Bill.

39 rows 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property. 2020 Tax Rates. Cities and towns in Rhode Island set tax rates to pay for things like schools parks and law enforcement.

The first step towards understanding Rhode Islands tax code is knowing the basics. A financial advisor can help. FY 2019 Property Tax Cap.

The average effective property tax rate in Rhode Island is 153 the 10th-highest in the country. Our Search Covers City County State Property Records. Income tax rate schedule.

6 unit apt Commercial Industrial Mixed Use. Masks are required when visiting Divisions office. 2021 Tax Rates.

How does Rhode Island rank.

Georgia Property Tax Calculator Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Property Taxes By State Embrace Higher Property Taxes

Rhode Island Property Tax Calculator Smartasset

Property Tax Breakdown Welcome To The Belvidere Township Assessor S Website

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Tarrant County Tx Property Tax Calculator Smartasset

Property Taxes Explained Omaha Relocation

Property Taxes By State 2017 Eye On Housing

Property Taxes By State 2017 Eye On Housing

Property Tax Comparison By State For Cross State Businesses

Property Taxes How Much Are They In Different States Across The Us

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

New York Property Tax Calculator 2020 Empire Center For Public Policy

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

Property Tax How To Calculate Local Considerations

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star