lexington ky property tax bill 2020

Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein. Various sections will be devoted to major topics such as.

Fill Free Fillable Forms Lexington Fayette Urban County Government

Oldham County collects the highest property tax in Kentucky levying an average of 224400.

. 859-252-1771 Fax 859-259-0973. Monday Wednesday Thursday 830 AM - 430 PM. 781-862-0500 Town Office Building Hours.

Lexington KY 40507 TEL. Lexington ky property tax bill 2020 Sunday May 8 2022 Edit. For any taxpayers property that is assessed by the.

The exact property tax levied depends on the county in Kentucky the property is located in. Lexington Ky Adds More Police Downtown Amid Worries. Different local officials are also.

Lexington ky property tax bill 2020. Receipts are then dispensed to associated entities as predetermined. Property Tax Search - Tax Year 2020.

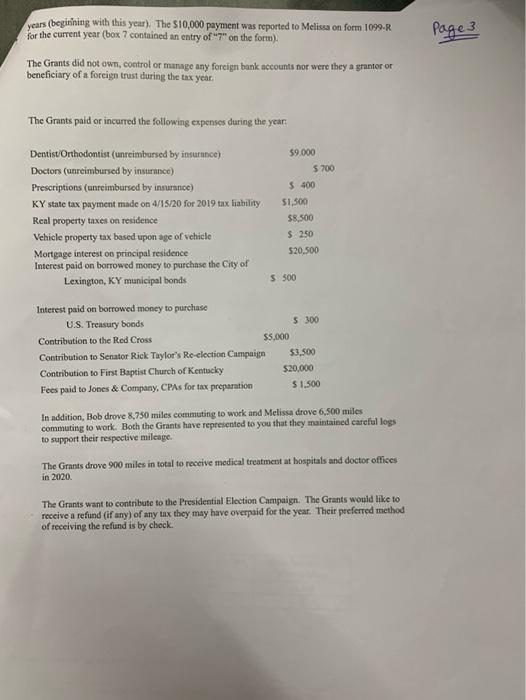

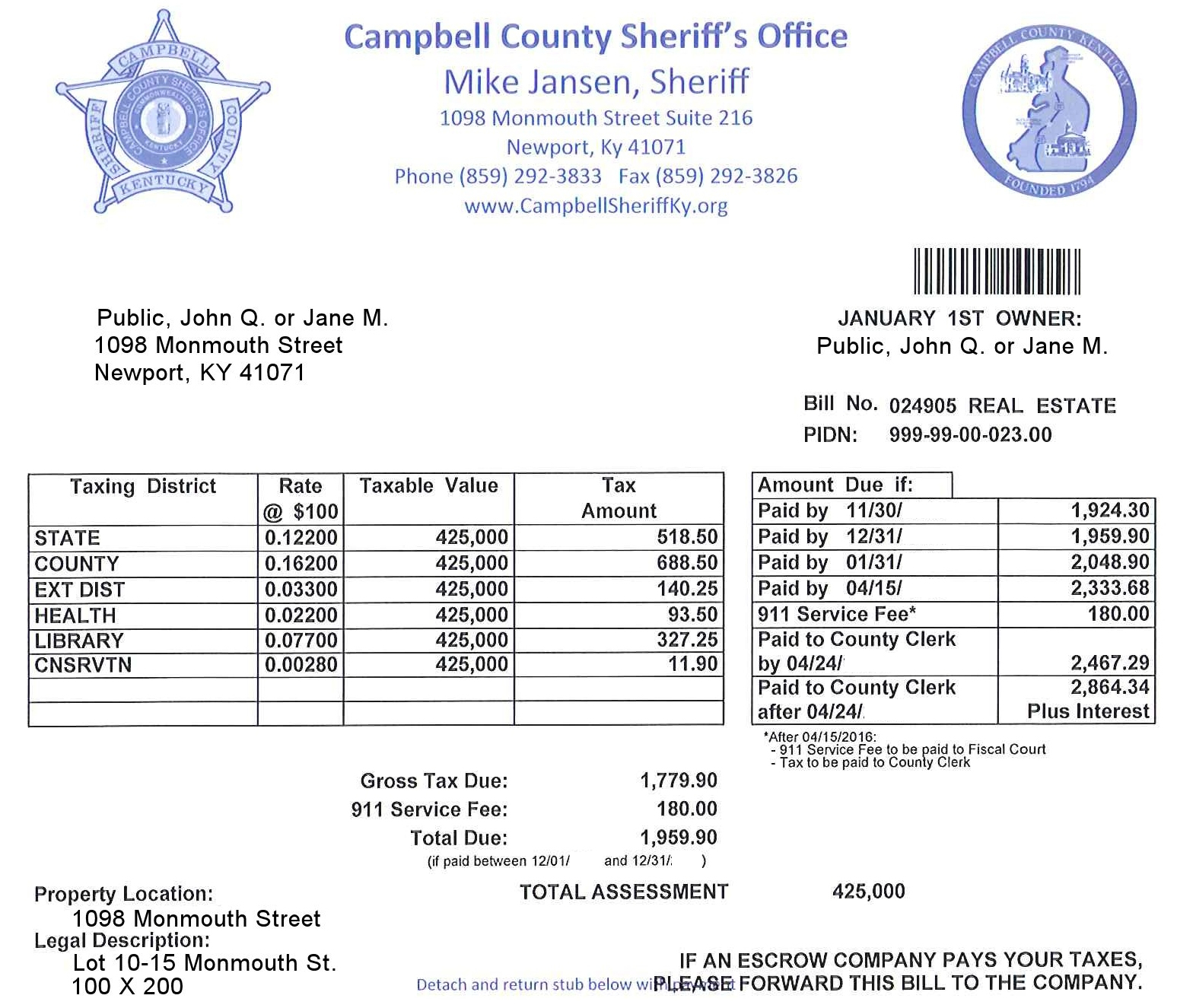

To use this search you must provide the Last Name of the primary owner of the vehicle and the Vehicle Identification Number VIN. Each year the County Clerks Office is responsible for conducting a tax sale on the delinquent tax bills. Information at the top of the tax bill identifies the property that this tax bill is for.

Property Taxes Frequently Asked Questions. Needs to reduce its tax rate from 278 cents per 100 of assessed valuation that was levied. The Property Valuation Administrators office is responsible for.

The assessment of property setting property tax rates and the billing and collection process. BY PVA ACCOUNTPARCEL NUMBER. Three items at the top of a real estate tax bill that identify the property are.

This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky. In light of the ongoing COVID-19 State of Emergency declared by Governor Beshear and the effect of the State of Emergency on the. 2139 Palms Dr Lexington Ky 40504 Realtor Com.

Maintaining list of all tangible personal property. Lexington KY 40507 Tel. Lexington Town Office Building 1625 Massachusetts Avenue Lexington MA 02420.

During the tax sale the delinquent tax bills are. Their phone number is 859 254-4941. There are three primary steps in taxing property ie formulating levy rates appraising property market values and.

Lexington Fayette Kentucky Ky Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Property Tax Faq Fayette County Sheriff S Office Lexington Ky

2020 Larkspur Dr Lexington Ky 40504 Mls 20124766 Zillow

Lexington Ky Lewis Brisbois Bisgaard Smith Llp

4835 Leestown Rd Lexington Ky 40511 Mls 22020400 Rockethomes

Clerk Network Department Of Revenue

2637 Rolling Rdg Lexington Ky 40511 Mls 20125984 Zillow

Taxbill Mike Jansen Campbell County Sheriff S Office

3240 Bracktown Rd Lexington Ky 40511 Realtor Com

440 Ridgeway Rd Lexington Ky 40502 Mls 22005688 Redfin

Lexington S Most Expensive Homes On The Block

1106 Oakwood Dr Lexington Ky 40511 Realtor Com

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

147 Forest Ave Lexington Ky 40508 Trulia

From 1973 To Today The Risks Of Funding Public Education By The Property Tax Kentucky Law Journal

10 Acre Lawns Get Benefit Meant For Working Fayette County Farms Lexington Herald Leader