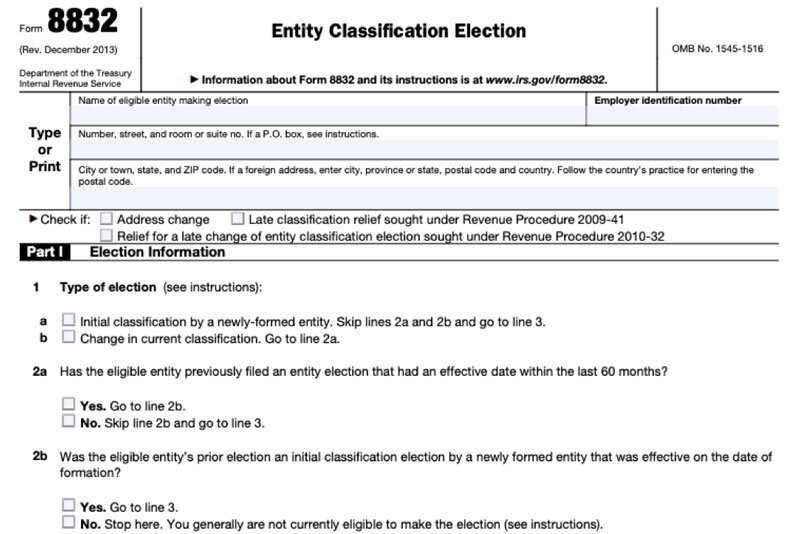

flow through entity irs

Participate Any rental without regard to whether or not the taxpayer materially participates A single entity. Flow-through entities FTEs affect an individuals Foreign Tax Credit FTC by impacting foreign source gross income foreign s ource taxable income worldwide gross income worldwide.

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

The most common type of flow-through entity is.

. Passive Activity A trade or business in which. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. A flow-through entity is a business in which income is passed straight to its shareholders owners or investors.

Flow-Through Entity Tax - Ask A Question. Log on to Michigan Treasury Online MTO to update. A flow-through entity is an entity through which income flows to the owners or investors without being subject to taxation at the entity level.

Flow Through Entity means an entity that for the applicable tax year is treated as a subchapter S corporation under section 1362a of the internal revenue code a general partnership a trust a. Trade or business and dispositions of interests in partnerships engaged in a trade or business within the United States made to a foreign flow-through entity are the owners or beneficiaries of. The payees of payments other than income effectively connected with a US.

Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated. However the late filing of 2021 FTE returns will be accepted as timely if filed. Its gains and losses are allocated or flow through to those.

The IRS treats sole-proprietorships as disregarded entities which means that the owner reports business income and expenses. As a result only the individuals not the business are taxed. A flow-through entity is a legal entity where income flows through to investors or owners.

Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity.

A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. A flow-through entity is a foreign partnership other than a withholding foreign partnership a foreign simple or foreign grantor trust other than a withholding foreign trust or for payments. In this legal entity income flows through to the owners.

That is the income of the entity is treated as the income of the investors or owners. Rules for Flow-Through Entities. Sole Proprietorships as Pass-Through Entities.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. A trust maintained primarily for the benefit of. Branches for United States Tax Withholding provided by a foreign.

The business income tax base refers to the flow-through entitys federal taxable income and any payments and items of income and expense that are attributable to the business activity of the. This disconnect between receipt of cash and.

Pass Through Taxation What Small Business Owners Need To Know

9 Facts About Pass Through Businesses

New York State Pass Through Entity Tax Sciarabba Walker Co Llp

Irs Permitting Pass Through Entity Salt Deduction Workaround

Trends In New Business Entities 30 Years Of Data Legal Entity Management Articles

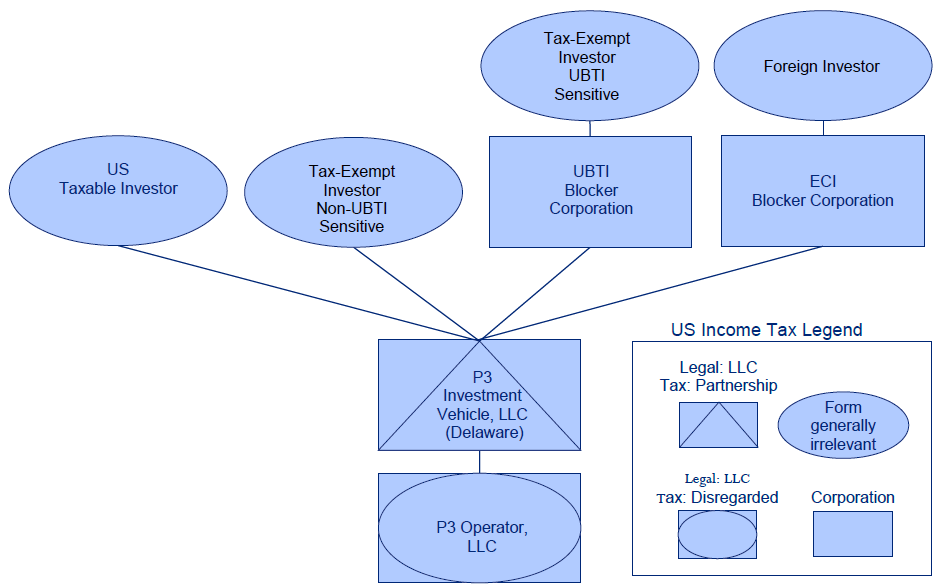

Fhwa Center For Innovative Finance Support P3 Toolkit Publications Reports And Discussion Papers

4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

What Are Pass Through Businesses Tax Policy Center

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

8 19 1 Procedures And Authorities Internal Revenue Service

Do I Qualify For The Qualified Business Income Qbi Deduction Alloy Silverstein

Part Ii Irs Form W8 Imy Fatca Driven More On The W 9 And W 8 Alphabet Soup With Fatca Irs Form W8 Imy Tax Expatriation

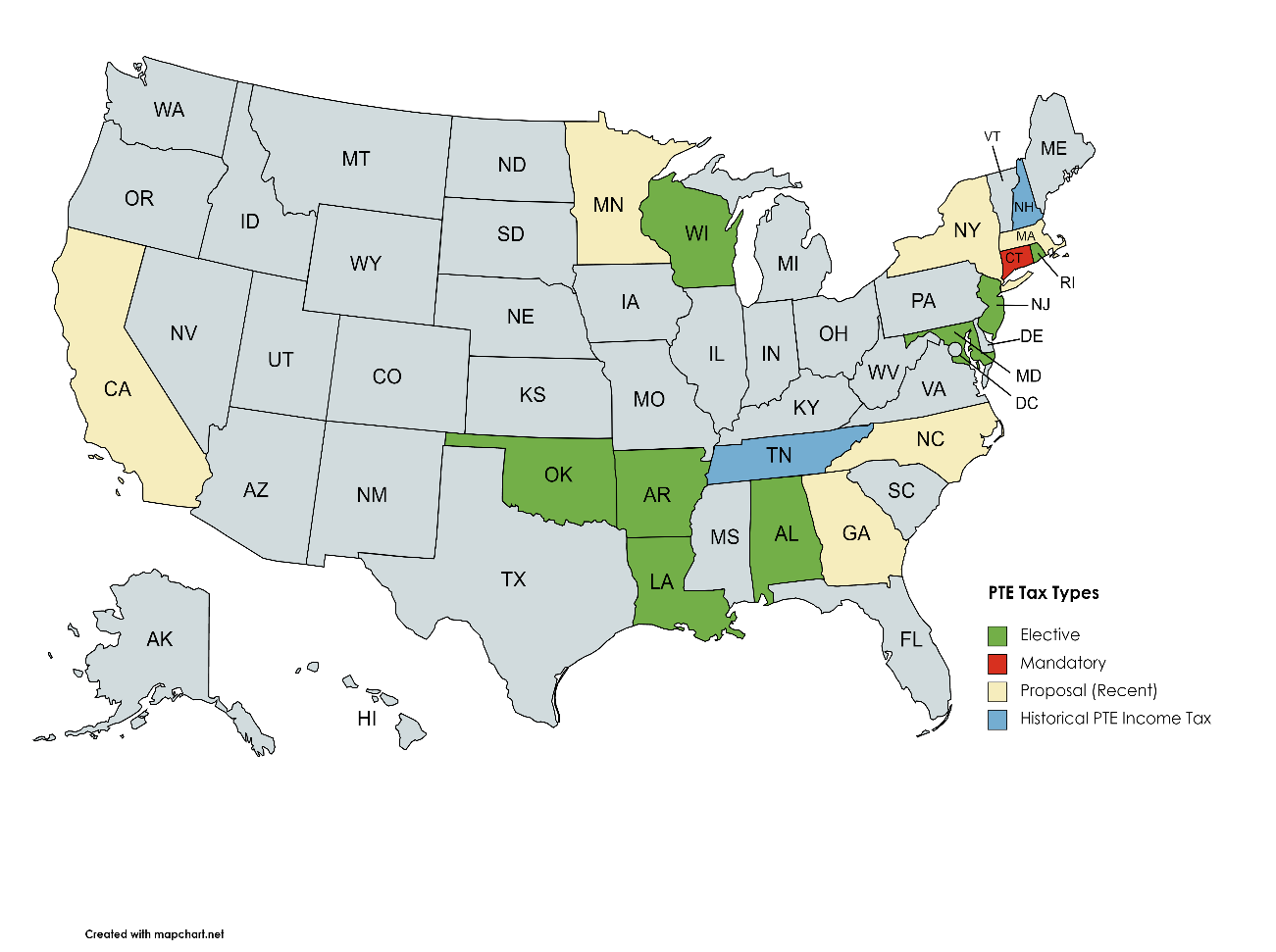

The Rapidly Changing Landscape Of State And Local Pass Through Entity Pte Taxes Withum

Irs Allows Pass Through Entity Workarounds To Salt Deduction Limitation Kulzer Dipadova P A

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Good News For Taxpayers Who Are Partners Or Shareholders In Connecticut Pass Through Entities Irs Provides Certainty Regarding The Deductibility Of Pet Tax Payments Connecticut State Local Tax Alert